Texas Bank Statement Loans

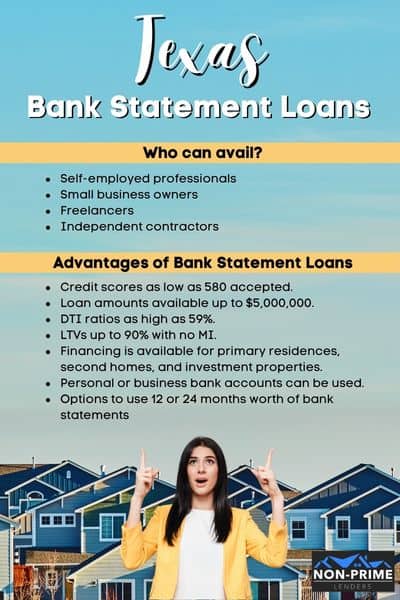

Self-employed borrowers, as well as those who earn seasonal income, may be eligible to qualify for a bank statement loan program. Bank statement loans allow you to use your bank statement to verify income instead of tax returns. These programs are utilized by a wide range of self-employed professionals, including small business owners, freelancers, independent contractors, and many other types of self-employed people.

What Do Bank Statement Loans Offer?

Bank statement lenders offer programs with the following advantages:

- Credit scores as low as 580 accepted.

- Loan amounts available up to $5,000,000.

- DTI ratios as high as 59%.

- LTVs up to 90% with no MI.

- Financing is available for primary residences, second homes, and investment properties.

- Personal or business bank accounts can be used.

- Options to use 12 or 24 months worth of bank statements (and one lender that allows you to use only 1 month’s bank statement).

The exact requirements to get a bank statement loan vary from lender to lender. You can view 5 of the best bank statement lenders below. If you would like some assistance finding a lender, we can help match you with a lender.

Click here to get matched with a bank statement mortgage lender

Texas Bank Statement Mortgage Lenders:

Below is a list of some of the best lenders that offer bank statement loans in Texas:

1 – Acra Lending

2 – Angel Oak Mortgage Solutions

The lenders featured above are some of the best mortgage lenders that offer bank statement loans. Would you like some assistance finding a lender? We can help match you with a bank statement lender that offers these loans in Texas. Click here to get matched with a mortgage lender

Bank Statement Loans in Texas

Bank statement loans are available in Texas through lenders who offer creative mortgage programs. The lenders who offer bank statement loans do not require tax returns for income verification purposes. The lender will ask you to provide bank statements to verify that your business is earning an income.

The lender will review 12-24 months of your bank statements to determine your average monthly deposits. Then, they will use a portion of that average to determine your gross monthly income on the loan application.

The Texas bank statement loan is available with a down payment as low as 10% for those who have excellent credit. You can expect the interest rates to be higher than conventional loans.

If you feel that you may not qualify for a bank statement loan, then the stated income program below may be the better solution for you.

Bank Statement Loan Interest Rates in Texas

The interest rates for bank statement loans offered in Texas will be higher than what you would expect from a conventional or FHA loan. How much higher will be determined by your credit score and how much you put down on the purchase.

If at any point after your purchase the rates drop or you find it possible to qualify for a conventional loan, you can always refinance.

Stated Income Loans in Texas

Stated income loans were very common a long time ago and up until the market crash. Then the lenders who offered these programs stopped offering them. However, there are some lenders who brought the stated income program back again.

Today, the stated income loan program does not require you to be self employed. You can be a W2 wage earner or even transitioning to being self employed. The down payment will be at least 20%-25% depending upon your credit score.

The requirements are going to change from time to time and as a result, we recommend that you contact us here to find out what your down payment would be.

This program is available for primary residences, second homes, and also investment properties. You may refinance at any time in the future if your income or employment situation changes.

Frequently Asked Questions

What is the minimum credit score required?

The minimum credit score required to get a bank statement loan depends on the lender. We work with a bank statement lender that offers bank statement loans to borrowers with credit scores as low as 500.

How much is the minimum down payment required?

The minimum down payment required depends on the lender. Several bank statement lenders allow down payment as low as 10%. The higher your credit score, the lower the down payment you will likely qualify for. Also, the loan amount will also influence the minimum down payment required (the larger the loan amount, the more the lender will likely require for the down payment).

What types of self-employed people are eligible?

Any type of self-employed professional might be eligible for a bank statement loan. This includes a wide range of people, including business owners, entrepreneurs, freelancers, gig workers, contractors, and many other types of self-employed professionals.

What types of properties can be purchased using this program?

Between all the lenders that offer this program type, nearly any type of home eligible. This includes single family residences, 2-4 unit properties, townhomes, condos, non-warrantable condos, and co-ops. Bank statement loans are available to finance second homes and investment properties.

How do I know if I eligible for a bank statement loan?

It is easy to find out if you qualify for a bank statement loan. All you will need to do is speak with a bank statement lender, and they can help you see if you qualify. If you would like to find out if you are eligible for a bank statement loan, we can help match you with a lender in your location. Click here to get matched with a bank statement lender

What documentation might be required to obtain the loan?

In addition to your bank statements, you should expect to be required to submit a business license, tax preparer’s letter, or your corporate paperwork. The exact documentation requirements will depend on the lender.

Is it possible to have a W-2 co-borrower?

Yes, you can have a co-borrower who uses their W-2 tax returns and income. They will be verified in a traditional manner, along with your income that is verified through bank statements.

Are there options to refinance with a bank statement program?

Yes, you there are options to refinance your mortgage with a bank statement program. This includes rate and term refinancing (to lower your rate and payment), as well as cash out refinancing.

Do lenders accept income received through credit card clearing houses?

Yes, some lenders allow income that is received through a credit card clearing house, such as PayPal, AMEX, or Square. All income sources are considered on a case-by-case basis, but as long as the income you receive makes sense for your type of business, you should be able to use the income received through these sources.

Can you use retirement income for these programs?

Any retirement income that is deposited into your bank account should be eligible to use for qualifying purposes.

Will having any NSF (non-sufficient funds) or overdrafts on my bank account affect my chances of qualifying?

Some lenders will have restrictions on the amount of NSF / overdrafts present on your account within a 12 month period. You may receive an exception, but it will ultimately depend on the lender’s guidelines, and the underwriter’s decision.

Have More Questions About Bank Statement Loans?

A bank statement lender can answer all of your questions about bank statement loans. If you would like to have a lender contact you, please fill out this form.