Top Stated Income Mortgage Lenders of 2024

After disappearing for many years, stated income loans are now back in 2024. Today’s stated income programs differ from the risky loan products that existed before the subprime mortgage crisis. New regulations strictly dictate what features a loan may have. Loans that meet these guidelines are known as “qualified mortgages”. Any loan that does not meet the necessary requirements is a non-qualified mortgage (commonly referred to as non-QM loans).

What is a Stated Income Loan?

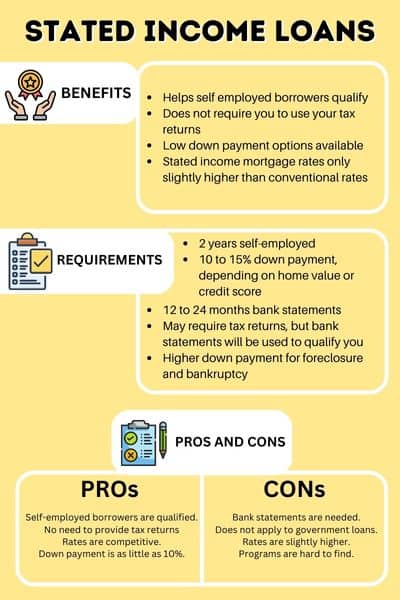

A stated income loan is a mortgage program offered by non-QM lenders for individuals who cannot fully document their income. They would “state” how much income they make without providing tax returns as proof.

This program is available to people who have not filed tax returns or for self employed borrowers who write off too much.

How the New “Stated Income Loans” Work

The “stated income loans” that exist in 2024 are different than the true stated income loans of the past. In the early 2000s, a borrower could often just state their income with no verification of any kind. The programs that are available today require that you actually prove your income, but you may be able to do so without the use of tax returns. Instead, the alternative way of verifying your income is accomplished using either 12 or 24 months worth of bank statements.

These new stated income mortgage loans are often referred to as “bank statement loans“, “alt doc loans”, or “alternative income verification loans”. Technically, you are not just merely stating your income, but rather using an alternative means to verify your income (both personal and business bank statements may be used).

Regardless of the lender, you should expect to be required to have at least a 500 credit score, and a larger than normal down payment (usually 10% or higher).

Click here to find out if you qualify for a stated income loan

Best Stated Income Lenders of 2024

Below is a list of some of the best stated income mortgage lenders of 2024. Each of these lenders currently offer options for alternative income verification (using bank statements in replace of tax returns). You may learn about each lender by visiting their website.

If you would like some help finding a mortgage lender, contact us here, and we will match you with a lender who can help based upon your location and down payment needs.

1 – Acra Lending (contact)

2 – Angel Oak Mortgage Solutions (contact)

3 – ACC Mortgage (contact)

4 – First National Bank of America (contact)

5 – Northstar Funding (contact)

6 – Carrington Mortgage (contact)

7 – A&D Mortgage (contact)

The mortgage lenders featured above are 7 of the top stated income / bank statement lenders. If you would like some assistance finding a mortgage lender, we would be glad to help.

Stated Income Cash Out Refinance

Lenders are offering stated income cash out refinances, but you may be limited to a 75% loan to value ratio. The seasoning requirement for the home will be one year.

The cash out funds can be used for anything and this program is available for both self employed and W2 borrowers. The closing costs can be rolled into the loan if you are unable to provide those costs out of pocket.

Stated Income Investment Loan

If you are purchasing an investment property, you can use a stated income loan if you are unable to qualify using the income on your tax returns. You will need to state enough income to cover the proposed mortgage payment, plus any other debt that appears on your credit report.

Simply complete this short contact form to discuss your options.

Click here to get matched with a mortgage lender

Frequently Asked Questions:

Who are these stated income programs intended for?

Any type of self-employed professional might be eligible for a stated income loan (bank statement loan). This includes a wide range of people, including business owners, entrepreneurs, freelancers, gig workers, contractors, and many other types of self-employed professionals.

Are these stated income loans available to purchase an investment property?

Yes, you may purchase an investment property or second home using one of these programs. The minimum credit score requirement is usually 680 or higher to purchase an investment property without using tax returns.

How many months of reserves is typically required?

Most non-prime lenders that offer these stated income loans will require that you have at least 12 months of mortgage payments in reserves. However, a few lenders do not have any reserve requirements if you have good credit and/or a large down payment.

Are there stated income loans available for jumbo loans and super jumbo loans?

Yes, there are stated income jumbo loans, as well as stated income super jumbo loans. These programs are available to purchase a home, or to refinance an existing mortgage. The maximum loan amount available is $10,000,000.

What is the typical down payment required?

Most mortgage lenders will require that you place at least 10-20% down. However, some lenders have been known to accept a lower down payment if you have excellent credit, strong reserves, and other aspects of your loan application that are strong.

What is the minimum credit score being accepted?

For most lenders, you should expect to need at least a 500 credit score. However, there are exceptions where someone with a lower credit score is approved, due to having strong compensating factors, such as a higher down payment.

What states are stated income / alternative documentation mortgages available?

Our network of non-prime lenders issues stated income mortgages in the following states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Wisconsin, and Wyoming.