Non Warrantable Condo Lenders

Are you looking to purchase or refinance a non-warrantable condo? You may be pleased to hear that there are many mortgage programs available that will allow you to finance non-warrantable condos. This includes special loan products, as well as FHA and VA loans.

What Makes a Condo Warrantable or Non-Warrantable?

Any condo that is not meet standards set by Fannie Mae or Freddie Mac is considered non-warrantable. The requirements for a condo to be warrantable are:

- The majority of the condos are owner occupied, and not investment properties or second homes.

- No more than 10% of the units can be owned by a single entity.

- There is not an abundance of units being offered on a short-term basis.

- A maximum of 25% of the total space can be used for commercial purposes.

- There can be no lawsuits against the HOA (homeowners association).

What specifically might cause a condo to be non-warrantable? Any property that is still under development would be considered non-warrantable. Also, any condo complex that is considered a “condotel”, or offers time shares is non-warrantable. Also, fractional ownership properties would fit into this category, as well as those that require you to join an organization, such as golf clubs.

Condos that do not meet the Fannie Mae or Freddie Mac guidelines, which are therefore non-warrantable, need to use other mortgage programs to obtain financing for their desired condo. Luckily, many loan programs are available. This includes options through government-backed programs through the FHA and VA. Additionally, there are many other non-prime loan programs available to finance a non-warrantable condo.

You can view some of the best mortgage lenders that offer programs for non-warrantable condos below. If you would like some help finding a lender, we would be glad to help.

Non Warrantable Condo Loans

Lenders who offer non warrantable condo loans have a different set of guidelines or requirements to finance these properties. They are unable to sell the loans to Fannie Mae which means the loans will remain in their own portfolios or sold to investors. This means the terms and requirements for non warrantable condo loans will be different.

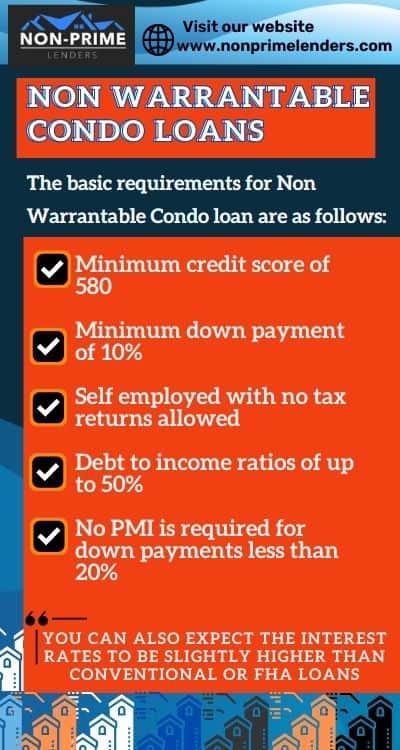

The basic requirements for Non Warrantable Condo loan are as follows:

- Minimum credit score of 580

- Minimum down payment of 10%

- Self employed with no tax returns allowed

- Debt to income ratios of up to 50%

- No PMI required for down payments less than 20%

You can also expect the interest rates to be slightly higher than conventional or FHA loans.

Click here to get matched with a mortgage lender

Non-Warrantable Condo Lenders

Below are some of the top non-warrantable condo mortgage lenders. This is just a small sample and they all may not be a good fit for you. Contact us and we will help you to find the best lender for a non-warrantable condo.

1 – Acra Lending Contact

4 – Alterra Home Loans Contact

5 – Hurst Lending Contact

6 – Blue Water Mortgage Contact

7 – First Heritage Mortgage Contact

These are some of the best mortgage lenders that offer financing options for non-warrantable condos. If you would like some assistance finding a lender, we would be glad match you with a lender that offers non-warrantable condo loans in your location.

Click here to get matched with a non-warrantable condo lender

FHA Loans for Non-Warrantable Condos

The FHA rules for condos are more lenient that what is required by Fannie Mae and Freddie Mac. The FHA states that at least 51% of the properties must be owner occupied. Also, if the condo complex is newly developed, at least 70% of the units must have already been sold.

VA Loans for Non-Warrantable Condos

The guidelines for financing a non-warrantable condo with a VA loan are similar to FHA loans. The VA requires that the majority of condos (51% or more) are owner occupied.

Frequently Asked Questions

How do I find out if a condo is warrantable?

If you are interested in determining the eligibility of a particular condo, a lender can assist you. Depending on the location of your condo, a loan representative will help you check to see if it is warrantable or non-warrantable.

What states are there mortgage programs for non-warrantable condos?

Financing is available in all 50 states.

Can a foreign national obtain financing for a non-warrantable condo?

Yes, we work with lenders that offer foreign national mortgages, which these loans may be used to purchase an eligible non-warrantable condo.

Is cash out refinancing an option?

The lenders we work with offer cash out refinance loans with a maximum LTV of 75%.

What is the maximum LTV allowed?

Nearly every lender will have a max LTV of 80%. This means that if you are making a purchase, you will need to put 20% down.

Are there any options to finance a non-warrantable condo as an investment property?

Yes, these loans are available to purchase or refinance an investment property. Generally, the maximum LTV on an investment property will be lower (60-70%) on an investment property.