With so many potential borrowers unable to obtain a home loan for an ordinary bank, many non-bank mortgage lenders have emerged that are providing financing opportunities for people that have been shut out from such typical lending institutions. These non-bank mortgage lenders serve a wide range of borrowers, especially the self-employed and credit challenged.

If you are seeking to purchase a home, or to refinance your existing mortgage, and would like to be connected with a non-bank lender, fill out this form, and we will do our best to connect you with the most suitable non-bank lender for your mortgage.

What is a Non Bank Lender?

A non bank lender is a mortgage lender that offers mortgages but not the full compliment of banking services such as deposit accounts, checking and savings accounts, or investment vehicles.

Non bank mortgage lenders often offer mortgage products and solutions that traditional banks do not offer. They also may be willing to have more flexible lending guidelines than what you may find with a traditional bank.

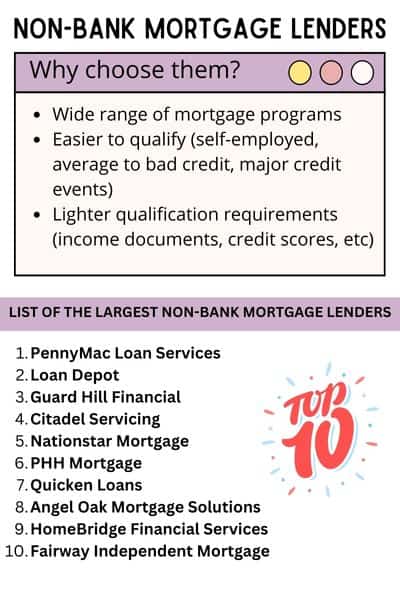

Below is a Top 10 List of the Largest Non Bank Mortgage Lenders:

There are many non-bank mortgage lenders in 2024. The following non bank lenders list includes some financial institutions that are offering alternative mortgage loans: Click to get Matched Based Upon Your Needs and Location

2 – Loan Depot

4 – Penny Mac

6 – PHH Mortgage

7 – Quicken Loans

8 – Angel Oak Mortgage Solutions

9 – HomeBridge Financial Services

10 – Fairway Independent Mortgage

The above 10 lenders are just some of the largest non-bank mortgage lenders. There are many other great options. If you would like some assistance determining which lender is likely to offer you the best home loan, we will do our very best to match you with such lender.

Click here to be matched with a non-bank mortgage lender.

Alternative Mortgage Lenders

Alternative mortgage lenders are also considered to be non-bank lenders that offer mortgage programs that fully licensed banks may not offer. They include mortgage solutions for some or all of the following needs and scenarios:

- Credit scores too low to qualify for a conventional loan

- Do not have a two year work history

- Cannot verify income using traditional documentation

- You have a recent chapter 7 or chapter 13 bankruptcy

- You or one of the borrowers on the mortgage does not have a social security number

- You simply prefer not to provide all of the documentation that a bank my require

- A very fast closing is needed

If any of these scenarios sound familiar to you, or if you have a different challenge, then we can help you.

Mortgage Programs that Alternative or Non Bank Lenders Offer

Some of the various alternative programs that a non bank lender may offer are referenced in the list below. We have a corresponding article that will go deeper into the requirements for each type of loan. Then, we can help you to pre-qualify or to get a quick quote without pulling credit right here.

Bank Statement Loans – This is for self employed borrowers who cannot use tax returns to verify how much they really make. Read more here.

Recent Bankruptcies – For people who have a recent Chapter 7 or Chapter 13 bankruptcy, there are mortgages that can help without the typical waiting period that you may find with a conventional or FHA loan. Read more here.

Low Credit Scores – There are many people who have very low credit scores and unfortunately, most lenders require scores that are higher. There are solutions for people who have scores in the low to mid 500’s. Read more here.

No Social Security Number – If you do not have a social security number, you can still get a mortgage with an ITIN number. Read more here.

FAQ – Non Bank Lenders

Who Are the Largest Non Bank Mortgage Lenders?

Two of the largest non bank mortgage lenders are Quicken Loans and Rocket Mortgage. They are online lenders that advertise a lot and originate many loans. However, they also have narrow guidelines and do not offer mortgages for very low credit scores or for unique scenarios. This means the largest non bank mortgage lenders may not be the best for everyone.

How do the mortgage programs that non-bank mortgage lenders offer differ from ordinary banks?

Ordinary banks tend to only offer more traditional mortgage programs, particularly conventional loans. Non-bank mortgage lenders offer a much wider range of mortgage programs, including Non-QM loans (non-qualified mortgages). Non-bank lenders also issue the majority of FHA Loans.

What are some of the biggest differences between a bank and non-bank mortgage lender?

Aside from the clientele that they most often serve, non-bank lenders tend to exclusively issue mortgage loans, and do not offer deposit accounts (such as checking and savings accounts).

There are also some differences in how they are regulated, and non-banks have less oversight than ordinary banks. However, the CFPB (Consumer Financial Protection Bureau) recently launched a non-bank supervision program in order to monitor the lending practices of non-bank institutions. The purpose of this is supervision is to ensure that non-bank lenders play by the same standards and rules as banks.

Is it easier to qualify for a mortgage with a non-bank mortgage lender?

Generally speaking, it is often much easier to qualify for a mortgage with a non-bank mortgage lender, than with a typical bank. This is especially the case for borrowers who are self-employed, or that have bad or average credit, as well as people who have experienced a major credit event in recent years (such as a bankruptcy, foreclosure, or short sale). Finally, the fact that non-banks are not regulated in the same way as banks allows them to offer different programs and qualification requirements.

Why has there been such a rise in the emergence of non-banks offering mortgages?

There are many reasons for the rise of non-banks in the mortgage marketplace, and the decrease of banks. One of the biggest reasons for this has been the withdrawal of banks offering mortgages due to the amount of regulations and compliance rules that has made banks more hesitant to offer home loans.

There are hefty penalties if banks due not adhere to the strict compliance rules set forth by the Consumer Financial Protection Bureau, which is making banks shift their focus to other areas of their business than originating and servicing mortgage loans.

What percent of mortgages are serviced by non-bank lending institutions?

According to an article published by Bloomberg, non-banks now service over 50% of new mortgage originations. This is a huge increase in a rather short period of time, which indicates this trend of non-banks taking a larger share of the mortgage marketplace to likely to only increase overtime. Further evidence of this is that in 2011, Fannie Mae only purchases 33% of mortgages from non-bank mortgage lenders, and by 2013 this increased to 47%.

Are credit unions considered to be non-bank lenders?

Technically, credit unions are not banks. Therefore, they could be considered non-bank mortgage lenders. However, credit unions often do offer deposit accounts, and categorically speaking, are viewed separately than the sort of non-bank financial institutions discussed on this page.