Are you looking to purchase a home in Texas, but do not have a social security number? An ITIN mortgage loan may be the perfect solution for you to finance a home purchase in Texas. If you have an ITIN number (individual taxpayer identification number), you may qualify for one of these loan programs.

Texas ITIN Loan Requirements

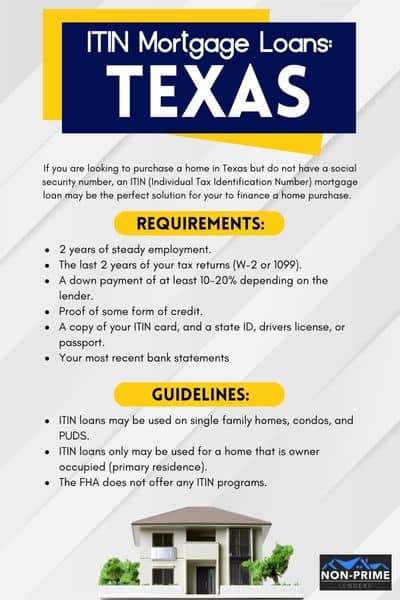

In order to qualify for an ITIN loan in Texas, you will need to satisfy the lenders requirements. Most lenders offering these programs will require the following:

- 2 years of steady employment.

- The last 2 years of your tax returns (W-2 or 1099).

- A down payment of at least 10-20% depending on the lender.

- Proof of some form of credit. A standard credit report is usually not required, but they may want to see you provide proof of paying bills such as those for home utilities and cell phones.

- Identification in the form of a copy of your ITIN card, and a state ID, drivers license, or passport.

- Your most recent bank statements (some lenders will want to see the last 2 months, but others may require up to 6 months).

Texas ITIN Mortgage Lenders

Below are some of the top ITIN mortgage lenders in Texas. Keep in mind not all of them have the down payment or program that you may need. Complete this short ITIN quote form and someone who is bilingual and also offers ITIN loans in Texas will call you.

1 – Dream Home Financing Contact

4 – Texas Pride Lending Contact

5 – First National Bank of America Contact

6 – Go Alterra Contact

7 – ACC Mortgage Contact

8 – United Mortgage Corporation Contact

Would you like some help finding an ITIN lender? We can help match you with a mortgage lender that offers ITIN loans in Texas.

Click here to get matched with a lender

Document Requirements for Texas ITIN Mortgage Loan Applications

When applying for an ITIN mortgage loan, you will need to gather the necessary documents to support your application. These documents typically include:

- Proof of identification: Provide a valid and unexpired passport or national identification card.

- Proof of income: Submit recent pay stubs, tax returns, W9’s, or other documentation that verifies your income and employment status.

- Proof of residency: Show evidence of your current address, by providing an ID or documentation from a lease agreement or utility bill.

- Bank statements: Provide statements from your bank accounts to demonstrate your financial stability.

- Credit history: Obtain a copy of your credit report to assess your creditworthiness.

- Additional documentation: Depending on the lender’s requirements, you may need to provide additional documents, such as proof of assets or a letter of explanation for any irregularities.

Step-by-Step Guide to Applying for an ITIN Mortgage Loan in Illinois

Follow these steps to apply for an ITIN mortgage loan:

- Research lenders: Find lenders that offer ITIN mortgage loans and compare their terms and requirements.

- Gather documents: Collect all the necessary documentation to support your application.

- Pre-qualification: Get pre-qualified by the lender to determine the approximate loan amount you may be eligible for.

- Complete the application: Fill out the application form provided by the lender, ensuring all information is accurate and complete.

- Submit documentation: Attach all the required documents with the application form.

- Review and approval process: The lender will review your application and documentation, conduct a credit check, and assess your eligibility.

- Underwriting and appraisal: If your application is approved, the lender will perform a residential appraisal of the property and complete the underwriting process.

- Loan commitment: Upon successful underwriting, you will receive a loan commitment in the form of a letter outlining the terms and conditions of the loan.

- Closing: Schedule and attend the closing. This is where you will sign the ITIN loan documents and pay any applicable fees.

ITIN Loan Down Payment Requirement in Texas

If you are looking for an ITIN loan in Texas, the smallest down payment available is 15%. The down payment for ITIN loans is determined by your credit score. If you have a credit score of at least 700, then a 15% down payment is possible.

As your credit scores decline, the down payment requirement will increase. People with poor credit may need 25-30% down for an ITIN loan.

ITIN Loan Credit Score Requirement in Texas

The minimum credit score requirement for an ITIN loan in Texas is 600. On occasion, lenders may drop their requirements to allow for scores as low as 580. Keep in mind the lower the credit scores, the higher the down payment will be.

Frequently Asked Questions

Can I buy a house with an ITIN number in Texas?

You can buy a house with an ITIN number in Texas if you can meet the basic income requirements, have the down payment needed, and have been employed for at least two years.

Is there an ITIN down payment assistance program?

Lenders who offer ITIN loans do not provide down payment assistance, but there are organizations in the local communities that may offer the assistance you need.

What types of properties are eligible for these loans?

ITIN loans may be used on single family homes, condos, and PUDS.

Can an ITIN loan be used for an investment property?

No, ITIN loans only may be used for a home that is owner occupied (primary residence).

Are ITIN loans available through the FHA?

No, the FHA does not offer any ITIN programs.

Are there any laws against mortgages being issued to borrowers without a SSN?

There are no laws that exist that restrict mortgage loans being offered to non-citizens. It is just that most lending institutions have a preference to only offer loans to borrowers with a social security number. Additionally, neither Fannie Mae, Freddie Mac, or the FHA back these types of loans creating difficulties pertaining to the secondary mortgage market. Thus, only unique types of lenders, namely “portfolio lenders” offer these types of loans.

ITIN loans are most popular in California, Colorado, Illinois, Oregon, Texas, Michigan, and Washington state, but are available in all 50 states.

Other Articles to Read

Spanish Speaking Loan Officers