Florida Bank Statement Loans

Bank statement loans and Stated income mortgages are becoming available again in Florida. This includes a handful of mortgage lenders that offer what are known as “alternative income verification loans”, which are also often called “alternative documentation mortgage loans”, or “bank statement loan programs”. All of these terms are interchangeable and mean the same thing.

These new loan products differ from the pre-recession mortgage programs, which were infamously known as “liar loans”. Today’s stated income loans actually require that your income be verified, however there are flexible options in how this verification takes place.

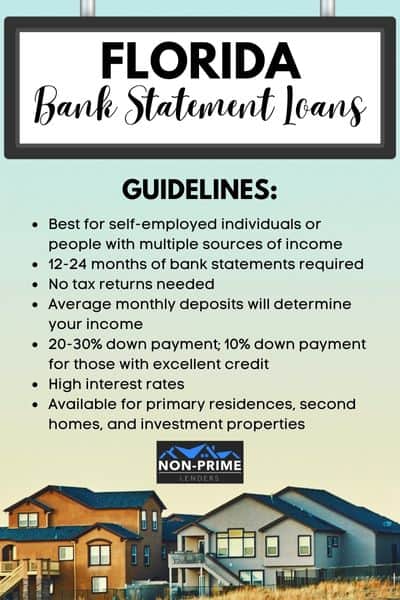

Participating stated income lenders often allow either 12 or 24 months of bank statements to be used instead of tax returns. This is most helpful for borrowers who receive their income from many sources, such as those who are self employed.

Click to get a free quote without pulling credit

Below is a list of the top stated income lenders in Florida that offer bank statement programs. We recommend completing this contact form and we will match you with the best lender for your scenario.

Florida Stated Income Mortgage Lenders:

1 – Acra Lending

3 – Angel Oak Mortgage Solutions

5 – Green Box Loans

6 – Oaktree Funding

Would you like help seeing if you qualify for a home loan with these lenders and more? Contact us for assistance. We offer a free lender matching service.

Bank Statement Loans in Florida

Bank statement loans are available in Florida through various non traditional or non QM lenders. The lenders who offer bank statement loans do not require tax returns to verify your income. Instead, they will ask you to provide anywhere from 12-24 months of your bank statements.

The lender will analyze the bank statements to determine your average monthly deposits. Then, they will use a percentage of that average to determine your gross monthly income on the loan application.

The Florida bank statement loan is available with a down payment as low as 10% for those who have excellent credit. You can expect the interest rates to be higher than conventional loans.

If you have not been self employed for at least two years, then you may need the stated income program referenced below.

Stated Income Loans in Florida

Stated income loans were extremely popular 20 years ago. However, after the market crash in 2008 most of these programs were discontinued. There are a handful of lenders who brought the stated income program back again.

Today’s stated income loan does not require you to be self employed, but the down payment will be at least 20%-25% depending upon your credit score. The guidelines are constantly changing so it is best to contact us here to find out what your down payment would be.

This program is available for primary residences, second homes, and also investment properties. You may refinance at any time in the future if your income or employment situation changes.

No Income Verification Loans in Florida

If you are looking for a no income verification loan in Florida, your best option will be the stated income loan. Although the bank statement loan does not require tax returns, you still need to verify your average monthly bank deposits.

If you have an FHA loan, you can refinance with the FHA streamline refinance which does not require any kind of income verification.

Frequently Asked Questions

Q: What type of bank statements can be used?

A: Any personal or business bank statement is allowed. Some lenders will only qualify 50% of the business bank account deposits. You should be able to use the combined amounts of any bank accounts or financial institutions that you collect income into.

Q: What other documentation is needed to qualify?

A: You will most likely need to provide a profit and loss statement. As far as we are aware, all stated income lenders in Florida. require a profit and loss statement for their bank statement program. These are also known as P&Ls.

Q: What is the typical down payment needed?

A: Each lender has their own down payment requirements, but most require at least 20-30%.

Q: Can these loans be used to purchase investment properties?

A: Yes, in fact these loans are very popular with investors.

Q: How long do I have to have been in business or self employed?

A: Most lenders will want there to be at least 2 years of business history.

Q: What sort of self employed people can qualify for stated income mortgages?

A: Any legitimate business will qualify. This includes a variety of business owners and contractors.