Mortgage After a Short Sale in 2024

Losing a home through a short sale or foreclosure can be a troubling experience. Many that go through this process feel a sense of hopelessness about becoming a homeowner again anytime in the near future.

Fortunately, the opportunity to purchase a home again after a short sale is becoming much easier. Fannie Mae recently reduced the waiting period from 4 years to 2 years for significant derogatory events, such as a short sale.

There are also new mortgage programs known as “non-prime loans”, which do not require any waiting period to get a mortgage after a short sale. This means that you may have an opportunity to get a mortgage even just 1 day after a short sale!

You can learn about the different waiting periods, and loan requirements, for conventional loans, FHA loans, and non-prime loans below.

Mortgage After a Short Sale Waiting Period – Chart

The following chart details how long you must wait after a short sale before getting approved for a new mortgage.

| Loan Type | Waiting Period |

| Conventional | 2-4 Years |

| FHA | 3 Years |

| VA | 2 Years |

| USDA | 3 Years |

| Subprime | No Waiting Period |

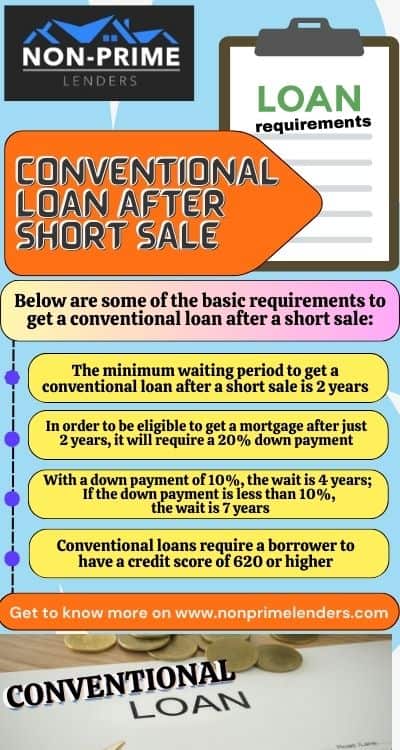

Conventional Loan After Short Sale

Below are some of the basic requirements to get a conventional loan after a short sale:

- The minimum waiting period to get a conventional loan after a short sale is 2 years. In order to be eligible to get a mortgage after just 2 years, it will require a 20% down payment. With a down payment of 10%, the wait is 4 years. If the down payment is less than 10%, the wait is 7 years.

- Conventional loans require a borrower to have a credit score of 620 or higher.

Would you like to see if you qualify for a conventional loan? We can match you with a mortgage lender that offers conventional loans in your location.

Click here to get matched with a mortgage lender

FHA Loan After Short Sale

Below are some of the basic requirements to get an FHA loan after a short sale.

- The FHA rules usually require a 3 year waiting period after a short sale. However, there are exceptions to this rule. If you were not in default at the time of the short sale, and if you made your payments on time for the 12 most recent months, you may not have any waiting period. Also, if you can prove that you had “extenuating circumstances” that caused your short sale, you may not be required to wait 3 years.

- FHA loans required a borrower to have a credit score of 500 or higher.

- The minimum down payment on FHA loans is 3.5%. However, in order to be eligible for a 3.5% down payment, you must have a credit score of 580 or higher. With a credit score between 500-579, a borrower will need to put 10% down.

Would you like to learn more about the requirements to get an FHA loan?

Or, if you would like to be contacted by an FHA lender, please fill out this form.

Non-Prime Loan After Short Sale

Below are the requirements to get a non-prime loan after a short sale:

- Non-prime loans do not require any waiting period after a short sale. This means that you may be able to get a new mortgage even just 1 day after a short sale.

- Most non-prime lenders have a minimum FICO score requirement around 500. However, there are some non-prime lenders do not have any minimum FICO score requirement at all (which means your credit score could be below 500).

- The minimum down payment requirement depends on the lender. Some lenders offer non-prime loans with down payments as low as 10%, but it is common for the minimum down payment to be closer to 20% (or higher).

Would you like some help finding a mortgage lender? We can help match you with a lender that offers non-prime loans in your location.

Click here to get matched with a mortgage lender

Non-Prime Lenders with no Waiting Periods

Below is an example of 3 lenders that do not require a waiting period after a short sale. Keep in mind that this is just a sample and the lender that is best for you may not be listed here. If you complete this short form, we will help find the best option for your specific situation.

1 – Acra Lending

Acra Lending offers a non-prime mortgage program that allows a borrower to get a mortgage 1 day after a short sale.

- The minimum FICO score required is 575.

- Loan amounts available up to $3,000,000.

- DTI ratios up to 50%.

- Up to 90% LTV with no MI (if you are 2 years from your short sale). If you a 1 year from your short sale, you may qualify for up to an 85% LTV with no MI. If you are less than a year from your short sale, the maximum LTV you may qualify for is 80%.

- Available in the following states: AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MT, NC, NE, NH, NJ, NV, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, & WY

Click here to learn more about Acra Lending’s non-prime program

2 – Angel Oak Mortgage

Angel Oak Mortgage offers a non-prime mortgage program that allows a borrower to get a mortgage 1 day after a short sale.

- The minimum credit score to qualify is 500.

- Loan amounts up to $1,000,000.

- DTI ratios up to 50%.

- The maximum LTV is 90%.

- Loan amounts up to $1,000,000.

- Primary residences, second homes, and investment properties.

- Available in the following states: AL, AZ, CA, CO, CT, DE, DC, FL, GA, IL, IN, IA, KS, KY, LA, MD, MI, MN, MS, NJ, NV, NC, OK, OH, OR, PA, SC, TN, TX, UT, VA, WA and WI.

Click here to learn more about Angel Oak’s non-prime program

3 – Greenbox Loans

Greenbox Loans offers a non-prime mortgage program that allows a borrower to get a mortgage 1 after a short sale.

- You must have a 500 credit score or higher to qualify.

- The maximum LTV allowed is 85%.

- Loans are available up to $3,000,000.

- This program requires full income documentation.

- They offer this program in the following states: AZ, CA, CO, CT, DE, FL, GA, ID, IL, LA, MA, MD, MI, MS, NV, NJ, NC, OH, OK, OR, PA, TX,

Click here to learn more about Greenbox Loans non-prime mortgage program

Need Help Finding a Lender?

If you would like some assistance finding a lender, we can help match you with a lender that offers non-prime loans in your location.

Click here to get matched with a mortgage lender