Bank Statement Loans – Lenders, Programs, and Requirements

Self employed borrowers, as well as those who earn seasonal income, may be eligible to qualify for a bank statement loan program. Bank statement loans allow you to use your bank statements to verify income instead of tax returns. These programs are utilized by a wide range of self-employed professionals, including small business owners, freelancers, independent contractors, and many other types of self-employed people.

What Do Bank Statement Loans Offer?

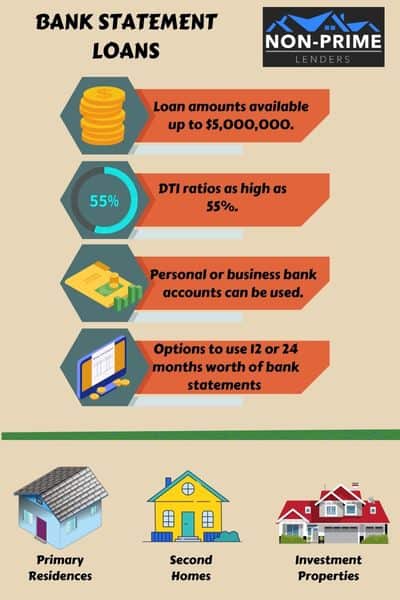

Bank statement lenders offer programs with the following potential advantages:

- Credit scores as low as 500 accepted.

- Loan amounts available up to $5,000,000.

- DTI ratios as high as 55%.

- LTVs up to 90% with no mortgage insurance.

- Financing is available for primary residences, second homes, and investment properties.

- Personal or business bank accounts can be used.

- Options to use 12 or 24 months worth of bank statements (and one lender that allows you to use only 1 month’s bank statement).

The exact requirements to get a bank statement loan vary from lender to lender. You can view 5 of the best bank statement lenders below. If you would like some assistance finding a lender, we can help match you with a lender.

Click here to get matched with a bank statement mortgage lender

Bank Statement Mortgage Lenders

Below are 5 of the best mortgage lenders that offer bank statement loans:

1 – Dream Home Financing

Dream Home Financing can help you to find a 12 month bank statement program that will allow you to use 100% of your personal account deposits, and 50%-75% of your business account deposits.

Details of Dream Home Financing’s Bank Statement Program:

- Loan amounts are available up to $3,000,000.

- Self-employed and 1099 borrowers are allowed.

- No 4506T required.

- Available for both owners occupied and investment properties.

- No waiting periods after a bankruptcy, foreclosure, or short sale.

- They offer these loans in all 50 states

Click here to contact Dream Home Financing about their bank statement program

2 – Angel Oak Mortgage Services

Angel Oak offers a 24 month bank statement program, which allows you to use both your personal and business bank statement accounts.

Details of Angel Oak’s Bank Statement Program:

- Loan amounts are available from $150,000-$3,000,000.

- Credit scores as low as 660 are accepted.

- Up to a 85% LTV with no MI.

- 2 years of self-employment required.

- Available for owner occupied and investment properties.

- 4 years seasoning after a bankruptcy, foreclosure, or short sale.

- They offer these loans in the following states: AL, AZ, CA, CO, CT, DE, DC, FL, GA, IL, IN, IA, KS, KY, LA, MD, MI, MN, MS, NJ, NV, NC, OK, OH, OR, PA, SC, TN, TX, UT, VA, WA and WI.

Click here to contact Angel Oak about their bank statement program

3 – Cross Country Mortgage

Cross Country Mortgage offers a 24 month bank statement (only personal bank statements may be used).

Details of Cross Country’s Bank Statement Program:

- Loan amounts are available up to $2,000,000.

- They do not have a set minimum credit score, but require good or excellent credit.

- The highest LTV allowed is 80%.

- DTI ratios up to 50%.

- Available for owner occupied, investment properties, and second homes.

- They offer these loans in the following states: AL, AK, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, ID, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, and WY.

Click here to contact Cross Country about their bank statement program

4 – Northstar Funding

Northstar Funding offers a 24 month bank statement program. You may use both your personal and business bank statements.

Details of Northstar’s Bank Statement Program:

- Loan amounts are available up to $5,000,000.

- The minimum credit score required is 680.

- The highest LTV allowed is 90%.

- DTI ratios up to 50%.

- Available for owner occupied and investment properties.

- They offer these loans in the following states: CA, CO, CT, DC, FL, GA, IL, MD, NC, NJ, NY, OR, PA, RI, and SC.

Click here to contact Northstar Funding about their bank statement program

5 – First National Bank of America

First National Bank of America offers a 12 month bank statement program. You may use both your personal and business bank statements.

Details of First National’s Bank Statement Program:

- No minimum loan amount.

- The highest LTV allowed is 75%.

- The maximum DTI ratio allowed is 55%.

- No waiting periods after a bankruptcy, foreclosure, or short sale.

- They offer these loans in the following states: AL, AR, AZ, CA, CO, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, MD, ME, MI, MN, MT, NC, NE, NH, NJ, NV, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, and WY.

Click here to contact First National Bank of America about their bank statement program

Need Help Finding a Bank Statement Lender?

The above lenders are just some of the best options for borrowers looking for a bank statement loan. If you would you like some assistance finding a bank statement mortgage lender, we would be glad to help you. Please fill out this form, in order to be matched with a lender.

Read our article about some basic bank statement loan questions.

Enjoy this article about home loans for contractors

We can help you find a bank statement loan in these states:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming